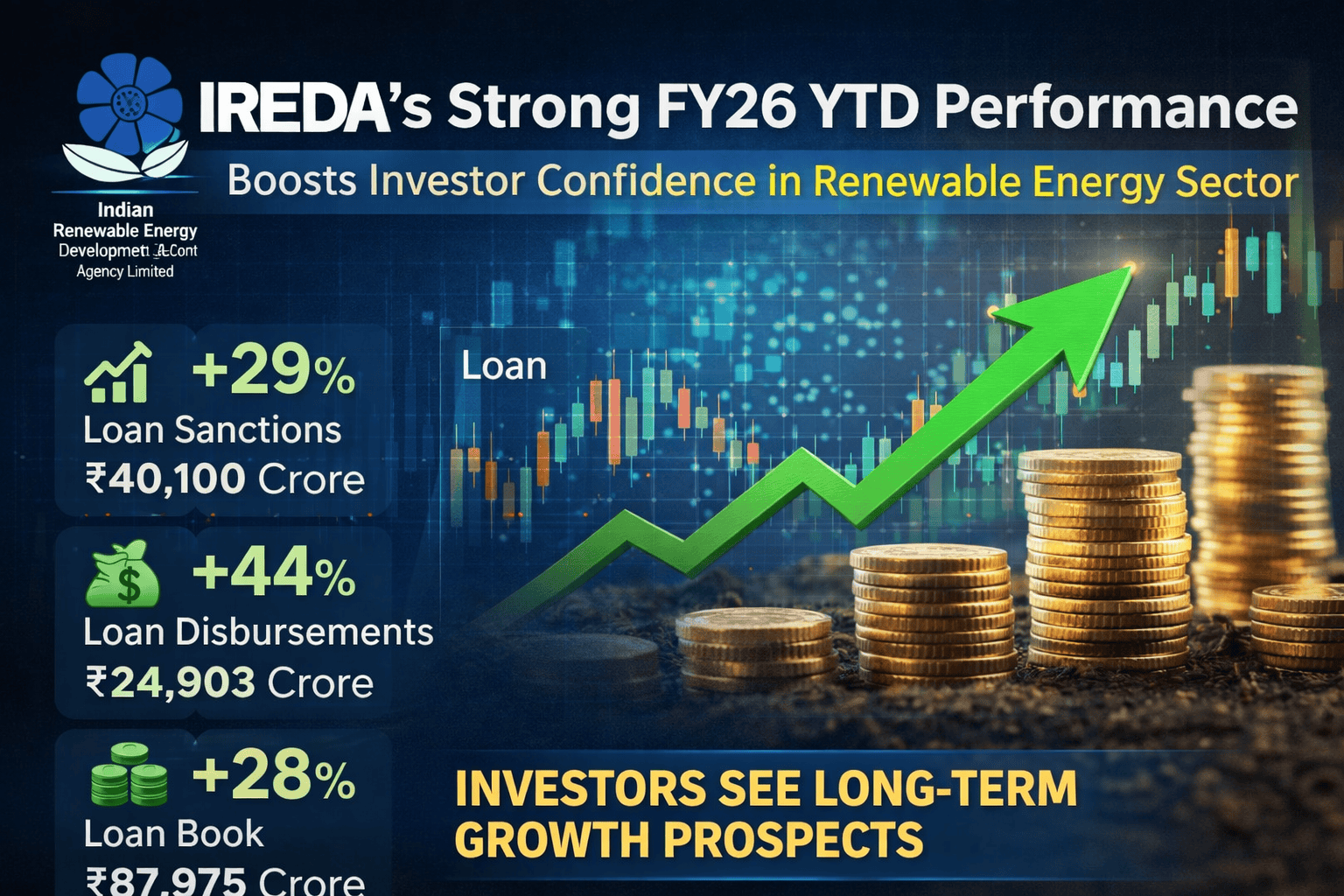

Indian Renewable Energy Development Agency Ltd. (IREDA) has posted a solid provisional business performance up to December 31, 2025, reinforcing investor confidence in the renewable energy financing space. The steady rise across key operating metrics highlights IREDA’s improving execution capabilities and its growing relevance in India’s clean energy expansion.

Strong YoY Growth Supports Investor Sentiment

IREDA’s loan sanctions increased by 29% year-on-year to ₹40,100 crore, reflecting sustained demand for financing across renewable energy projects. This growth indicates a healthy project pipeline and improving traction in solar, wind, and other green energy segments.

More importantly from a stock-market perspective, loan disbursements surged by 44% to ₹24,903 crore, suggesting faster conversion of sanctioned loans into actual revenue-generating assets. Higher disbursement growth often translates into better interest income visibility in the coming quarters.

Expanding Loan Book Strengthens Earnings Visibility

The company’s loan book outstanding stood at ₹87,975 crore, marking a 28% YoY growth compared to ₹68,960 crore in the same period last year. A growing loan book improves long-term earnings stability and supports sustained net interest income, a key metric closely tracked by equity investors.

This expansion also reflects increasing confidence of renewable energy developers in IREDA as a preferred financing partner.

What This Means for IREDA Stock

For investors, these numbers point towards:

- Strong business momentum in FY26

- Better earnings visibility due to higher disbursements

- Long-term growth potential aligned with India’s renewable energy targets

While the numbers are provisional and subject to audit, the trend suggests that IREDA remains well-positioned to benefit from India’s accelerating push towards clean and sustainable energy infrastructure.

| Particulars | Dec 31, 2025 (₹ Cr) | Dec 31, 2024 (₹ Cr) | Growth |

|---|---|---|---|

| Loan Sanctioned | 40,100 | 31,087 | 29% |

| Loan Disbursements | 24,903 | 17,236 | 44% |

| Loan Book Outstanding | 87,975 | 68,960 | 28% |

Outlook

With supportive government policies, rising renewable capacity additions, and increasing institutional focus on green finance, IREDA’s consistent business growth could continue to remain a positive trigger for the stock in the medium to long term.

Leave a Reply