Silver made headlines today with a sharp 5% surge — one of its biggest one-day moves in recent months. So, what’s driving this rally? Let’s break it down in simple terms.

1. Lower Interest Rate Bets

Markets are betting that the U.S. Federal Reserve will soon cut interest rates. When borrowing costs fall, precious metals like silver (which don’t pay interest) become more attractive to investors.

2. A Weaker U.S. Dollar

Silver is priced in dollars worldwide. When the dollar loses strength, international buyers get more value for their money — and that usually pushes silver higher.

3. Safe-Haven Demand

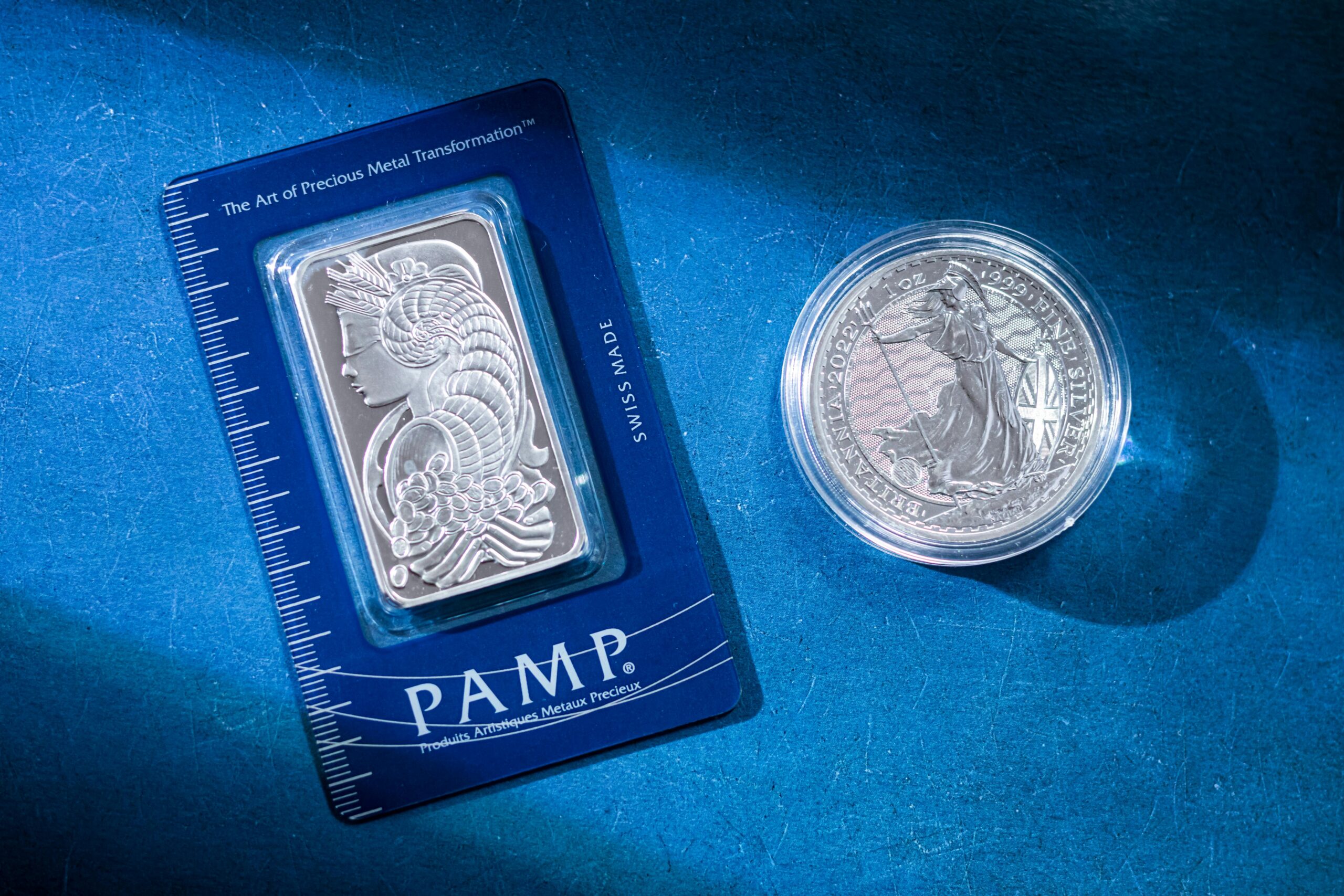

With global economic and geopolitical uncertainty, investors are seeking safer assets. Gold often takes the spotlight, but silver benefits too — especially because it’s more affordable.

4. Rising Industrial Use

Silver isn’t just a “precious metal.” It’s also essential for solar panels, electronics, and batteries. As demand grows from industries, tight supplies are helping fuel today’s price jump.

5. Local Market Boost (India Effect)

In India, silver futures also hit record highs. A weaker rupee has added extra momentum, making silver even more expensive in rupee terms.

Leave a Reply