October 16, 2025

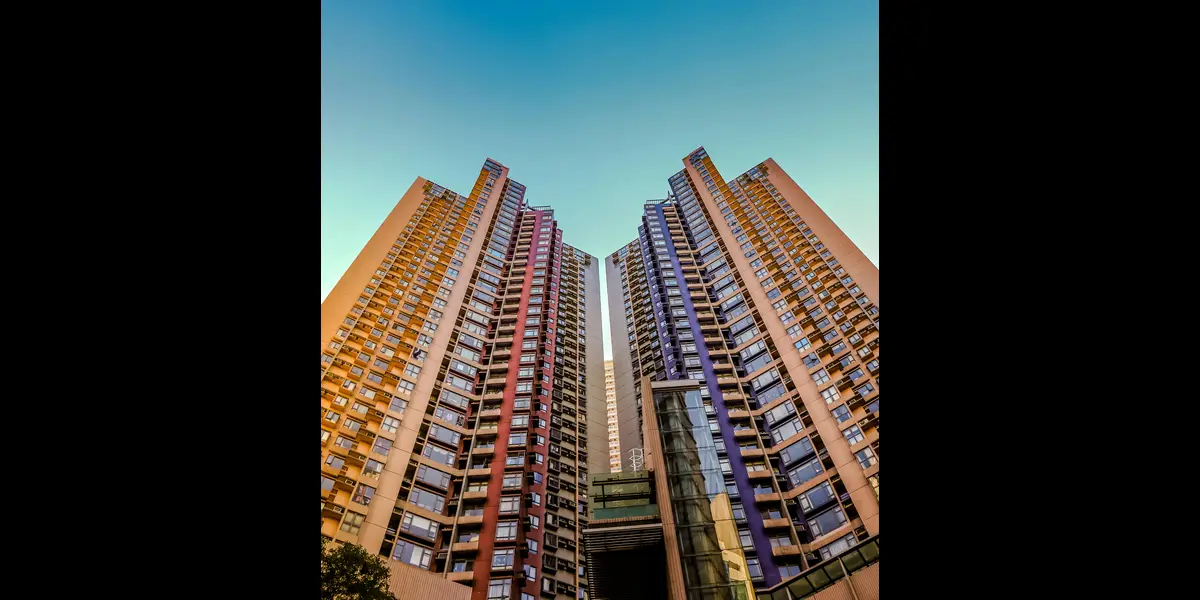

Real estate has always been a dream investment, but high prices kept most people away. Enter fractional real estate — a way to invest in property with as little as ₹1,000. This new trend is opening doors for millennials and first-time investors in India. Let’s explore how it works and why it’s worth considering.

What Is Fractional Real Estate Investing?

- Buying a share of a property instead of the whole thing.

- Ownership is proportionate to your investment.

- Income from rent or appreciation is shared among investors.

Platforms Offering Fractional Investments in India

- SmartOwner, PropertyShare, and MyPropertyAngel are some options.

- Each platform has different minimum investments and properties.

- Always verify platform credibility before investing.

Advantages Over Traditional Real Estate

- Low entry cost

- Diversification: invest in multiple properties

- Liquidity: easier to sell your fraction than whole property

Risks to Consider

- Market volatility affecting property values

- Platform fees or delays in payouts

- Limited control over property management

Step-by-Step Guide to Start

- Choose a reliable platform.

- Research properties and expected returns.

- Invest your desired amount.

- Track your portfolio and payouts regularly.

FAQs:

- Can I sell my fractional share anytime? → Usually yes, depending on platform policies.

- What returns can I expect? → Typically 5–12% annual, depending on property type.

- Is fractional real estate safe? → Safer than stock trading but still has risks.

Leave a Reply