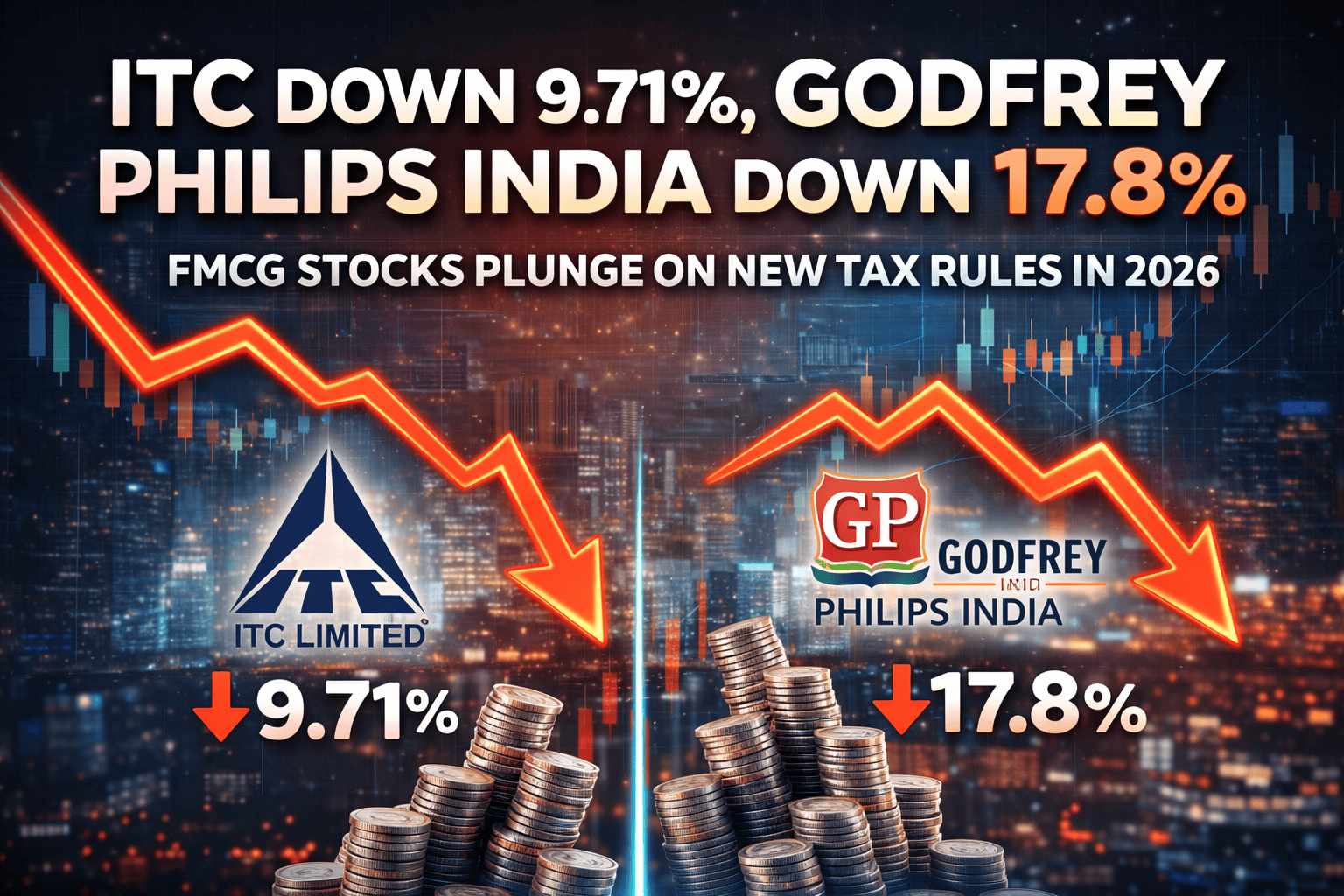

On the very first day of 2026, many popular Indian FMCG shares — especially those tied closely to tobacco products — saw a noticeable fall in their prices. This sudden move surprised many investors on New Year’s Day, a day when markets are usually calmer. The main reason behind this drop lies in the Indian government’s revised tax rules, which have just come into effect.

Let’s understand what changed, why the fall happened, and whether this correction is likely to be short-lived or could linger.

What’s Changed in the Tax Rules?

In late 2025, the Indian government updated certain tax regulations that affect consumer goods, but particularly tobacco products and related categories. Although the announcements were made earlier, the changes were scheduled to become effective from January 1, 2026. Because of this timing, the markets reacted sharply on the first trading day of the year.

The key changes include:

📌 Higher Tax Burden on Tobacco Items

Tobacco and related products are now subject to increased tax rates. This means companies that sell cigarettes and other tobacco goods will likely face higher costs or reduced margins — and consumers may have to pay more.

📌 Revision of Tax Calculation Methods

Some rules around how taxes are calculated on goods with mixed uses — such as items that include tobacco components — are now more stringent. This could affect pricing, profitability, and how companies manage their product portfolios.

These changes were not brand-new ideas; they were introduced earlier but only came into enforcement at the start of 2026. Because of that delay between announcement and implementation, many investors may not have fully priced in the impact until they saw the reality reflected in the market.

Why Did FMCG Shares Fall?

When the markets opened on January 1, stocks of companies with significant exposure to tobacco products — such as major FMCG names — dropped noticeably. Here’s why:

🟠 Profit Margin Concerns

Higher taxes mean the cost of producing and selling tobacco products could rise. For companies that make a large portion of their earnings from cigarettes and related goods, this can reduce expected profits.

🟠 Repricing of Future Earnings

Investors adjust the value they place on a company based on expected future profits. When a major cost component goes up, the present value of future earnings goes down — and share prices can drop in response.

🟠 Psychological Reaction

Market movements often reflect not only fundamentals but also sentiment. A sudden policy change can trigger short-term selling as traders re-assess their positions.

Is This a Small Correction or a Big Problem?

At this stage, it’s important to view the drop in a balanced way.

📉 Short-Term Reaction

The immediate fall in share prices is likely a short-term reaction to new rules now coming into effect. Traders and algorithmic strategies often respond quickly to policy changes, leading to sharp movements in prices.

In many cases, such reactions are temporary as markets digest the new information and prices find a fresh equilibrium.

📅 How Long Could This Last?

Three possible scenarios could unfold:

- Quick Stabilization (Within Days to Weeks)

If investors decide the tax changes are manageable and long-term earnings are still strong, the market may recover within a short period. - Moderate Continuation (Several Weeks to a Month)

If there is continued uncertainty about how companies will adapt — for example, whether they will pass the higher costs to consumers, or absorb them — the correction could extend longer. - Longer Adjustment (Several Months)

If deeper worries emerge about future demand, or if earnings forecasts are revised downward significantly, the impact could last longer. However, this would require widespread concern about structural harm to business models, which is not certain at this point.

At this moment, the fall appears more like a reaction to immediate policy effects, and not necessarily an indication of fundamental collapse.

What Should Investors Think About?

While this article is not offering specific buy or sell recommendations, a few thoughtful points can help frame your understanding:

⚖️ Look Beyond the First Reaction

Market drops on the first day of a new policy are often driven by short-term repositioning. Over time, fundamentals — like actual earnings, consumer behaviour, and company strategy — tend to matter more.

📊 Watch for Earnings Impact

Companies will soon start reporting their financials under the new regime. How they manage pricing, costs, and product mix will show up in performance numbers. Those results may influence longer-term stock direction more than the initial drop.

⏳ Think in Time Frames

Short-term price swings are normal in response to policy changes. Long-term investors often focus on trends over quarters rather than days.

📌 Observe Market Sentiment

If the broader market stabilizes and stock prices recover as investors absorb the outcome of the tax changes, it may signal confidence returning. Persistent weakness, however, could suggest deeper concerns.

Final Thoughts

A policy change that affects major revenue streams is bound to stir the markets — especially when it comes into force at the start of a new year. The drop in FMCG and tobacco-linked shares is understandable as investors reassess expectations.

However, such movements are often part of the market’s way of finding a new balance. Whether this adjustment becomes a brief wobble or a longer-lasting trend depends on how companies adapt and how investors interpret it.

In the meantime, staying informed, observing how earnings evolve, and thinking in terms of the broader picture — rather than reacting to a single day’s movement — can lead to more grounded perspective over time.

Leave a Reply