In a landmark moment for the global tech industry, Nvidia Corporation has officially become the first company ever to cross a $5 trillion market capitalization, cementing its dominance as the engine of the AI revolution.

Once known primarily for gaming chips, Nvidia is now the driving force behind artificial intelligence, cloud computing, robotics, and autonomous systems — making it the most valuable company in the world.

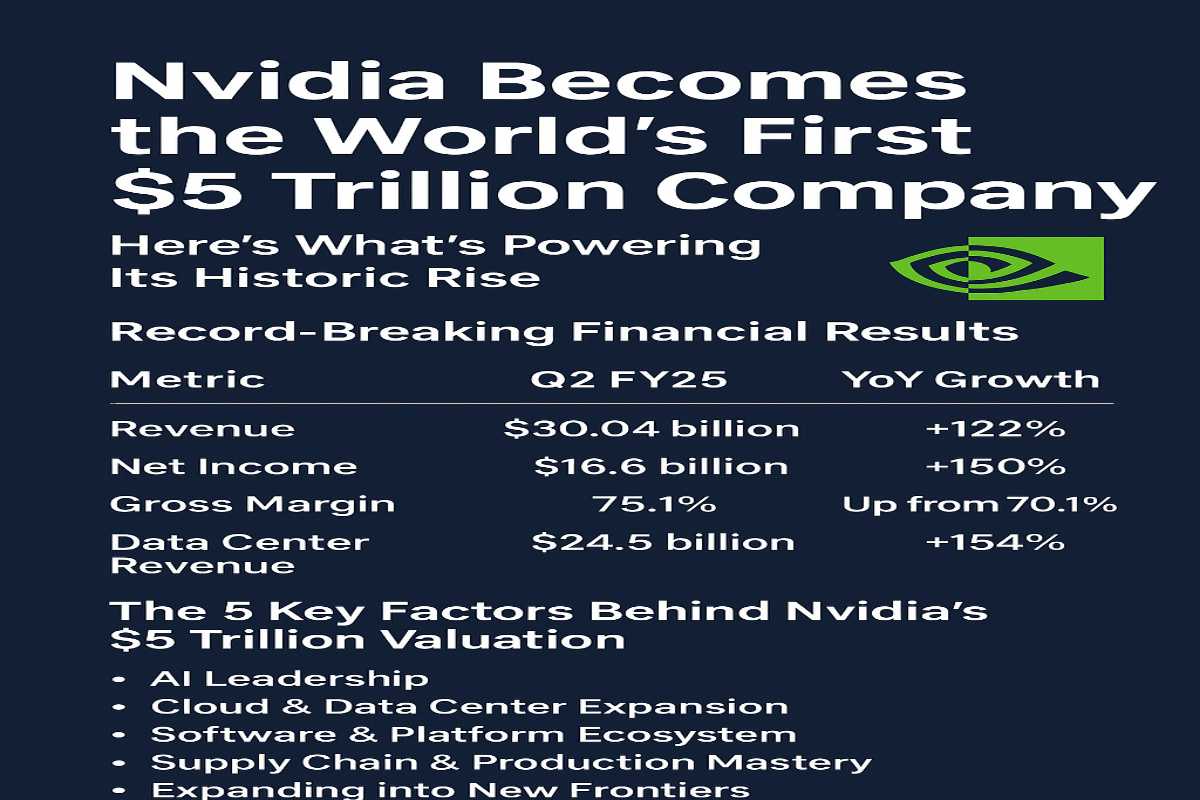

Record-Breaking Financial Performance

In its latest Q2 FY2025 results, Nvidia once again exceeded market expectations, posting staggering growth across all divisions.

| Metric | Q2 FY25 | YoY Growth |

|---|---|---|

| Revenue | $30.04 billion | +122% |

| Net Income | $16.6 billion | +150% |

| Gross Margin | 75.1% | Up from 70.1% |

| Data Center Revenue | $24.5 billion | +154% YoY |

(Source: Nvidia Investor Relations, August 2025)

Nvidia’s data center division — which supplies chips for AI model training and cloud infrastructure — now accounts for over 80% of total revenue, marking a massive shift from its gaming roots.

5 Key Factors Behind Nvidia’s $5 Trillion Valuation

1. AI Leadership

Nvidia’s GPUs are the gold standard for training and running large AI models used by companies like OpenAI, Microsoft, Google, and Amazon. Its Hopper and Blackwell chips have set new benchmarks in speed, power efficiency, and scalability.

2. Cloud & Data Center Expansion

The surge in global demand for AI computing has led cloud giants to buy Nvidia chips at record volumes. Its partnerships with AWS, Azure, Google Cloud, and Oracle continue to boost long-term recurring demand.

3. Software & Platform Ecosystem

Beyond hardware, Nvidia’s CUDA, AI Enterprise, and Omniverse platforms have created a sticky software ecosystem that locks in developers and enterprises — adding recurring, high-margin revenue streams.

4. Supply Chain & Production Mastery

By partnering with TSMC for advanced chip manufacturing and investing heavily in supply chain capacity, Nvidia has maintained a critical lead while competitors struggle with shortages and bottlenecks.

5. Expanding into New Frontiers

Nvidia is now venturing beyond AI chips — moving into robotics (Isaac), automotive (Drive), and digital twins (Omniverse) — broadening its reach across multiple trillion-dollar industries.

Investor Sentiment & Market Impact

Wall Street has hailed Nvidia’s rise as a “once-in-a-generation growth story.”

Analysts note that the company’s consistent execution, dominant market share, and unmatched AI moat justify its record valuation.

Nvidia’s CEO Jensen Huang credited the milestone to “the industrial revolution of AI,” saying:

“We’re witnessing the transformation of every industry — from computing to healthcare, from manufacturing to entertainment — powered by accelerated computing.”

What’s Next for Nvidia?

Even after hitting $5 trillion, Nvidia shows no signs of slowing down.

The company is:

- Scaling up next-gen Blackwell B200 GPUs for AI and data centers

- Expanding its AI Foundry Service to help enterprises train and deploy custom models

- Investing in energy-efficient chip design amid growing sustainability pressures

Analysts forecast Nvidia could reach $6 trillion by late 2026 if AI infrastructure spending continues its current trajectory.

Bottom Line

Nvidia’s rise to a $5 trillion market cap isn’t just a financial milestone — it’s a signal of how profoundly AI is reshaping the global economy.

With its unmatched technology, deep partnerships, and growing influence across industries, Nvidia isn’t just leading the AI revolution — it’s defining it.

Leave a Reply